Content

Using a double-entry system requires at least some level of formal training in accounting. The user must, for instance, have a solid grasp of concepts such as debit, credit, Chart of accounts, and the two Accounting equations. By contrast, just about anyone who can arrange numbers in a table and add and subtract, can set up and use a single-entry system. The choice also impacts the firm’s ability to track and manage assets, debts, and owner’s equity. The cash account is debited by $1 million, whereas the offsetting entry is a $1 million credit to the common stock account. Since the purchase represents a “use” of cash, the cash account is credited $250,000, with the offsetting entry consisting of a $250,000 debit to the equipment account.

On the next line, the account to be credited is indented and the amount appears further to the right than the debit amount shown in the line above. It is not used in daybooks , which normally do not form part of the nominal ledger system. The information from the daybooks will be used in the nominal ledger and it is the nominal ledgers that will ensure the integrity of the resulting financial information created from the daybooks . In a small business organization, daily shopping, a cultural ceremony, the application of a single entry system of accounting is more popular and advantageous than the double-entry system. As the accounting process under the double-entry system is complex and complicated, the possibility of errors and mistakes cannot be avoided completely.

Define Single-Entry and Double-Entry Accounting

So this amount is debited to your account and raises the account balance to $4500. Since the accounting process under the double-entry system is extensive, a good number of books are to be kept, and a large number of employees are employed for accounting work. Under this system double entry accounting of accounting, the future course of action can be formulated by comparing income -expenditure, asset, and liability of the current year with that of the previous year. If there is an exception to this, complete information will not be available in the books of accounting.

- And AuditorsAn auditor is a professional appointed by an enterprise for an independent analysis of their accounting records and financial statements.

- The double-entry accounting method was said to be developed independently earlier in Korea during the Goryeo dynasty (918–1392) when Kaesong was a center of trade and industry.

- Expense accounts detail numbers related to money spent on advertising, payroll costs, administrative expenses, or rent.

- Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts.

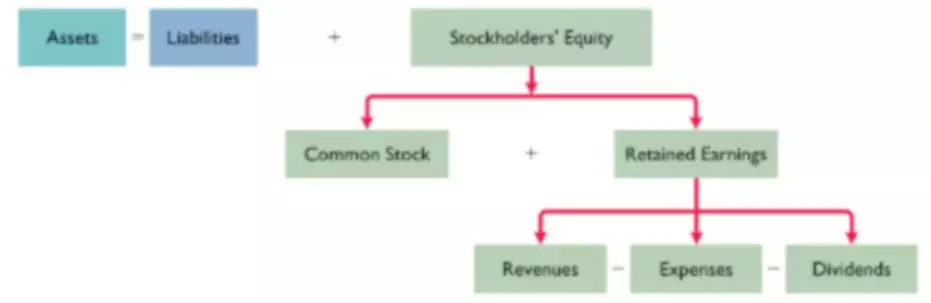

- The balance sheet is based on the double-entry accounting system where total assets of a company are equal to the total of liabilities and shareholder equity.

So, if you have one debit and one credit, they need to be the same. If you have multiple debits and credits, the sum of all debits needs to equal the sum of all credits. Not all accounts work additively with each other on the primary financial accounting reports—especially on the Income statement and Balance sheet. There are instances where one “account” works to offset the impact of another account in the same category. The so-called contra accounts “work against” other accounts in this way. In some situations, the contra accounts reverse the debit and credit rules from the table above. How the bookkeeper and accountant handle each transaction for an account depends on which of the five account categories includes the account.

Delivers a Complete Financial Picture

Rely on BC Templates 2021 and win approvals, funding, and top-level support. Example transactions illustrating the nature of double-entry accounting.

David Kindness is a Certified Public Accountant and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. Bookkeeping is an important https://www.bookstime.com/ activity for maintaining accurate financial records. Yet, many small businesses fail to implement it with efficiency. Bookkeeping can help you prepare a budget, check for tax compliance, evaluate your business performance and help you with decision-making. We bet you have thought about getting all of these operations in place for your business.

What Are the Different Types of Accounts?

The Structured Query Language comprises several different data types that allow it to store different types of information… The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. For example, you overpaid your electric bill in error last month, and you receive a refund of $200.00 from the electric company. Let’s say you just bought $10,000 of pet food inventory on credit. Master excel formulas, graphs, shortcuts with 3+hrs of Video.

Basically, double-entry bookkeeping means that for every entry into an account, there needs to be a corresponding and opposite entry into a different account. It will result in a debit entry in one or more accounts and a corresponding credit entry in one or more accounts. In this case, the asset that has increased in value is your Inventory. Because you bought the inventory on credit, your accounts payable account also increases by $10,000. System Of AccountingAccounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities.

Using Accounting Software

Every debit must have a corresponding credit and Vice – Versa. Double-entry Book-Keeping is a system by which every debit entry is balanced by an equal credit entry. Double entry accounting is used to balance the accounting equation. As such, entering any amount on one side of the equation requires entering the same amount on the other side. A trained bookkeeper can quickly see how a transaction affects the five big accounts, but it doesn’t come naturally to most of us. It’s a handy link between daily business activities and the five accounting buckets. The offsetting debit and credit transactions might look appear as follows in the bookkeeper’s journal.

- Through this balance sheet financial position of the business concerned can be ascertained.

- Very profit-making company in business sets up an accounting system to manage and track of its assets, liabilities, equities, revenues, and expenses.

- The change in one account is a debit , and the change in another is a credit .

- Here, every transaction must have at least 2 accounts , with one being debited & the other being credited.

- It can be detected through trial balance whether two sides of accounts are equal or not, and thereby the arithmetical accuracy of the account is verified.

- If you have multiple debits and credits, the sum of all debits needs to equal the sum of all credits.

One is a debit to the accounts receivable account for $1,500 and a credit to the revenue account for $1,500. This means that you are recording revenue while also recording an asset which represents the amount that the customer now owes you. The second entry is a $1,000 debit to the cost of goods sold account and a credit in the same amount to the inventory account. This records the elimination of the inventory asset as we charge it to expense. When netted together, the cost of goods sold of $1,000 and the revenue of $1,500 result in a profit of $500. A credit is that portion of an accounting entry that either increases a liability or equity account, or decreases an asset or expense account.

You invested $15,000 of your personal money to start your catering business. When you deposit $15,000 into your checking account, your cash increases by $15,000, and your equity increases by $15,000. When you receive the $780 worth of inventory for your business, your inventory increase by $780, and your account payable also increases by $780. For businesses in the United States, the Financial Accounting Standards Board , is a non-governmental body. They decide on the generally accepted accounting principles , which are the official rules and methods for double-entry bookkeeping. With a double entry system, credits are offset by debits in a general ledger or T-account. The key feature of this system is that the debits and credits should always match for error-free transactions.

- It has 3 major types, i.e., Transaction Entry, Adjusting Entry, & Closing Entry.

- In every organization, whether big or small accounts are kept under the double-entry system.

- If you’re ready to use double-entry accounting for your business, you can either start with a spreadsheet or utilize an accounting software.

- On the second day of the week you pay your rent, which is $1000.

- This is how you would record your coffee expense in single-entry accounting.

- Shelley Elmblad is an expert in financial planning, personal finance software, and taxes, with experience researching and teaching savings strategies for over 20 years.

IDYM India TV

IDYM India TV